Impact & Sustainability

Our mission consists in combining the vision of impact investing with the financial rigour and business-building capability of private equity to generate superior returns while delivering meaningful social and environmental impact, carefully targeted at major areas of needs in Western Europe.

For further information on our Impact and Sustainability approach, and Impact Expansion's alignement with Article 9 of the EU Sustainable Financial Disclosure Regulation (SFDR), please click on the following link:

-

We invest in businesses that provide best-in-class solutions to the identified areas of needs analysed in our Theory of Change

-

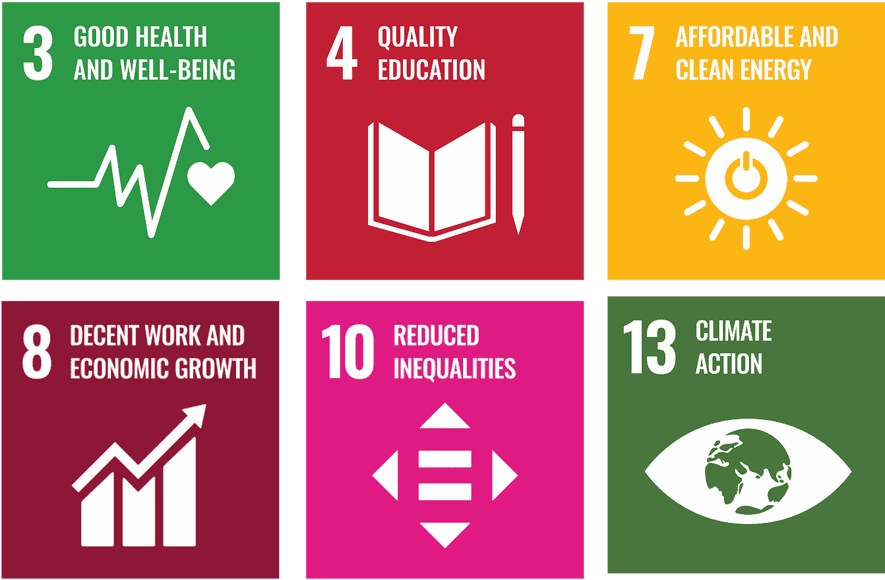

The Fund targets 6 of the 17 SDGs (# 3, 4, 7, 8, 10 and 13)

-

Organic growth and build-ups to reach leadership position and to scale the impact

-

Impact managed and measured throughout the investment process, using the Impact Management Project framework

-

Definition and tracking of 3 to 5 impact KPIs per portfolio company during the holding period impacting management remuneration

-

50% of Impact Expansion's team carried interest linked to the achievement of the Fund's impact targets

-

Transparent and integrated reporting to investors on a quarterly basis

We follow best-in-class practices of Impact Investing, including the definition of our intentionality, objectives, impact measurement and management and transparent reporting to key stakeholders.